When you sell goods to another country, did you know there is more to decide than just the price, delivery terms and transportation also needs to be agreed on. You need to ask yourself, who pays for the shipping? Who completes customs paperwork? Are the goods insured? When do you know who is responsible for the goods if they get lost or destroyed? This is where Incoterms apply.

Incoterms are a set of 11 rules which clearly define what is required from both the buyer and the seller. For example, if you want to arrange it so that the seller arranges everything, and the buyer doesn’t need to get involved or perhaps the seller will ship to the port and the buyer will take care of the rest or maybe the buyer wants to pick up goods from the seller’s warehouse, there are specific incoterms for all of these scenarios. Incoterms are universal and therefore when you quote an Incoterm for a shipment, your customer can look up the same information in their country. It does require negotiation when the sales contract is agreed on to make sure that you and your customer are both aware of their responsibilities within the contract.

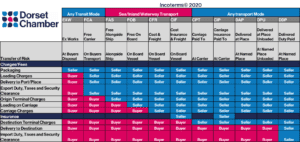

In some cases, buyers or sellers quote an incoterm when they are using a different terms rule, so please ensure you check who is responsible for what before agreeing to an incoterm. The below table clearly shows each term and which part is responsible for each step.

Q&A

Q: Is the use of Incoterms mandatory or voluntary?

A: There’s a misconception that Incoterms are mandatory or legally required. They’re neither. However, they’re highly recommended for use in contracts for the sale of goods to avoid miscommunication.

It’s also very important to state the version (year) of the Incoterm in the contract of sale. If you only specify the Incoterm, then by default, the 2020 rules will apply. It’s important to note that if a contract for sale was created prior to Jan. 1, 2020, then the former 2010 rules would apply for any Incoterms mentioned in that contract. Incoterms are updated/changed every 10 years.

Q: We have been using the wrong Incoterm, will we get in trouble?

A: If all customs and shipping charges are paid, and the goods are declared correctly, then you won’t get in trouble with the authorities. You should change your contract and invoices to reflect which term you are using for future sales.

Q: Where can I find more information?

A: Dorset Chamber have books which detail everything about each Incoterm. Please contact us for prices.

We also have courses on Incoterms, the next one is on the 23rd February and 7th April 2022.

You can find them and all our other courses on our website: www.dorsetchamber.co.uk/international-trade/latest-training-events/

What are the essential things to remember when you are importing goods?

- BE ACCURATE. KEEP PROOF.

When you’re declaring goods, you are making a legal declaration. Therefore, you must provide accurate information. Our top tip is to ensure that the figures you’re quoting on your customs declaration, or the numbers and details you’re instructing your agent to declare, are consistent in all of your documentation.

Why? Because HMRC will require paperwork to support what you’re declaring. For example, your goods may attract a documentary check: if you’ve declared that your goods weigh 200 kilos, HMRC will expect to see paperwork that confirms that the weight of the goods is 200 kilos.

And if you’ve done some strange calculations, arbitrarily apportioned weights and values, you may struggle to explain it or even remember what you did.

- BE CAREFUL WITH DISCOUNTS

Remember that not all discounts are allowable and just because you’ve received a discount from a trader, it doesn’t mean the value of the goods will be reduced.

Remember: the value of the goods is not necessarily the price that you paid for them.

For example, you could import goods that you have not paid for because they are free of charge, or they may be a gift.

However, if they are worth £10,000 – you will have to pay duty on that value and not on the price paid.

What are the essential things to remember when you are exporting goods?

- PROOF OF EXPORT

Make sure that you have proof of export when you are exporting goods.

When you’re the trader, and you’re exporting, you’re liable for UK VAT (Value-added tax) unless you can prove that you’ve not sold the goods within the boundaries of the UK.

- DON’T EXPORT USING INCOTERMS EX-WORKS.

Make sure you use at least FCA in your contracts. One of the reasons behind our suggestion is that with Incoterms FCA you retain the export documentation control, ensuring that the goods are being exported properly and are eligible for VAT zero-rating.

However, if you leave the responsibility to the seller, as with the EXW Incoterms, you’re effectively trusting a foreign party to comply with UK regulations and provide you with proof of export to support VAT zero-rating.