Clive Fortis, a director of Antony Batty & Company, Insolvency Practitioners and business turnaround specialists, points out how important it is for directors to ensure they carry out their responsibilities, especially right now.

“As we enter a 3rd national lockdown, it can only get harder and harder for many financially distressed companies to survive, despite government support. With the end of January tax bill likely to bring further financial hardship to companies struggling to survive, and with the first CBIL repayments, for example, only 3 months or so away, many businesses will be teetering on the edge of insolvency. That is when directors need to be especially vigilant.

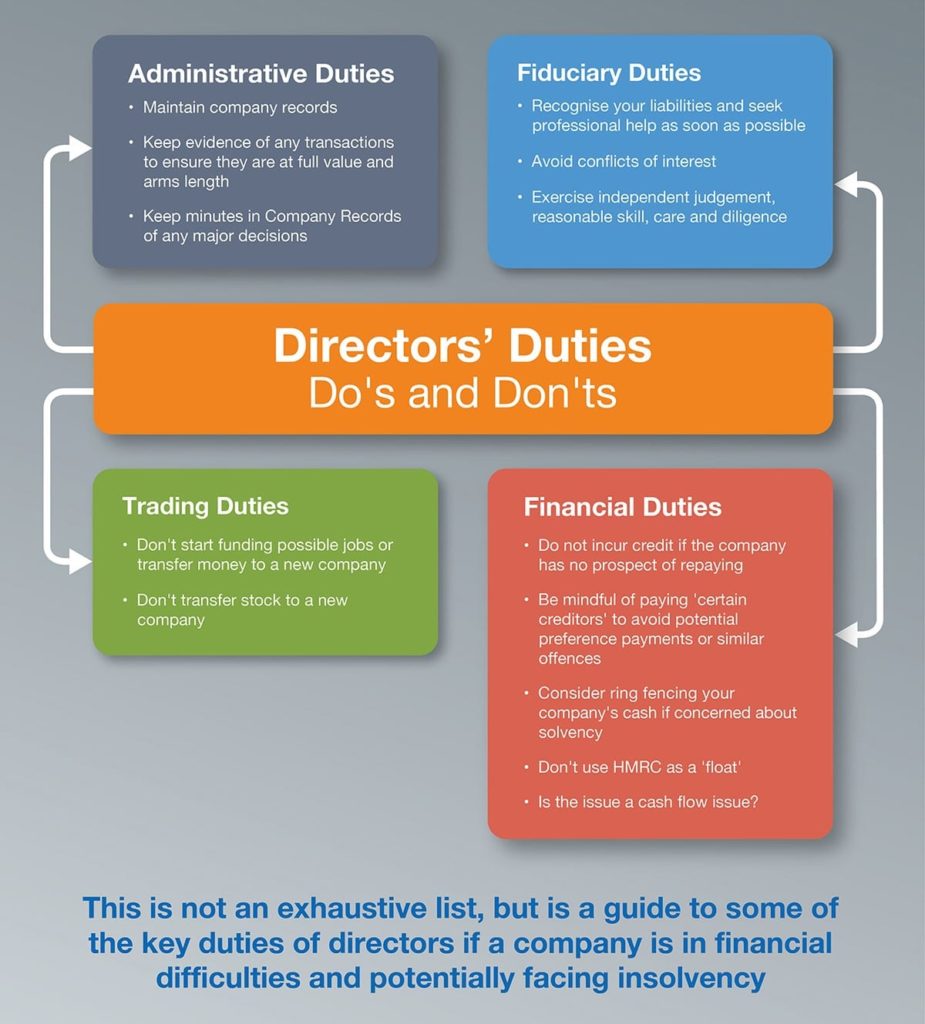

The fiduciary duties of directors at insolvency to their creditors and shareholders are unchanged by Covid-19. If insolvent, company directors must tread very carefully to avoid personal liability to creditors and the possibility of misfeasance claims, director disqualification, or even prison.

It is also worth highlighting that if CBILs are mis-used and the receiving company becomes insolvent, Insolvency Practitioners have statutory powers of investigation, with personal liability for directors again being a likely outcome for the outstanding loan.

The 4 key sins for directors to avoid (as detailed in the Insolvency Act, 1986) when their company is insolvent are:

• Wrongful Trading. This a civil offence and occurs when a company continues to trade whilst insolvent.

• Fraudulent Trading. This is a criminal offence where a director knows his/her company is insolvent and deliberately attempts to deny creditors what they are owed.

• Creditor Preferences. Directors must not show preference to one creditor over any other.

• Transactions at an Undervalue. Any transaction for asset disposal must be at arms-length and full value.

Directors must always be aware of their company’s financial position. Pleading ignorance is no excuse. Indeed, failure to recognise that a company is in financial difficulties is likely to be seen as irresponsible, negligent and proof of ‘unfit conduct’ by the directors.”

Advice for Directors

“One thing we know for certain is that the sooner under pressure directors act, the better the chance of survival. Figures from R3 (the Association of Business Recovery Professionals), for example, show that over 40% of insolvent businesses are rescued by Insolvency Practitioners. Options range from providing access to finance to help turnaround to the breathing space that insolvency procedures such as Company Voluntary Arrangements and Administrations provide. Liquidation is not inevitable.

In addition, the earlier directors talk to an Insolvency Practitioner the quicker they can be advised on what measures to take to avoid breaching their responsibilities.”

Contact-: Clive Fortis or Elaine Wilkins, Antony Batty & Co

Suite 218 Bourne House 23 Hinton Road Bournemouth BH1 2EF

clive@antonybatty.com | elaine@antonybatty.com