Antony Batty and Company suggests Directors looking to close their Solvent Company should act now.

Back in March 2021, we advised those businesses owners who were considering closing their solvent companies to act quickly as there was a chance that the Chancellor would reduce the benefit to be had from the Relief, or perhaps scrap it completely. In the event, no changes were made.

However, there is another budget due on 27th October 2021, and, once again it is considered likely that BADR will be in the firing line, as the Chancellor is known to be looking at ways of funding the cost of the Covid-19 pandemic.

Antony Batty comments:

“If BADR is scrapped, or the benefit is reduced, then directors looking to close their solvent companies through the use of a Members Voluntary Liquidation would not benefit from the current reduced rate of Capital Gains Tax, which has saved many £000s.”

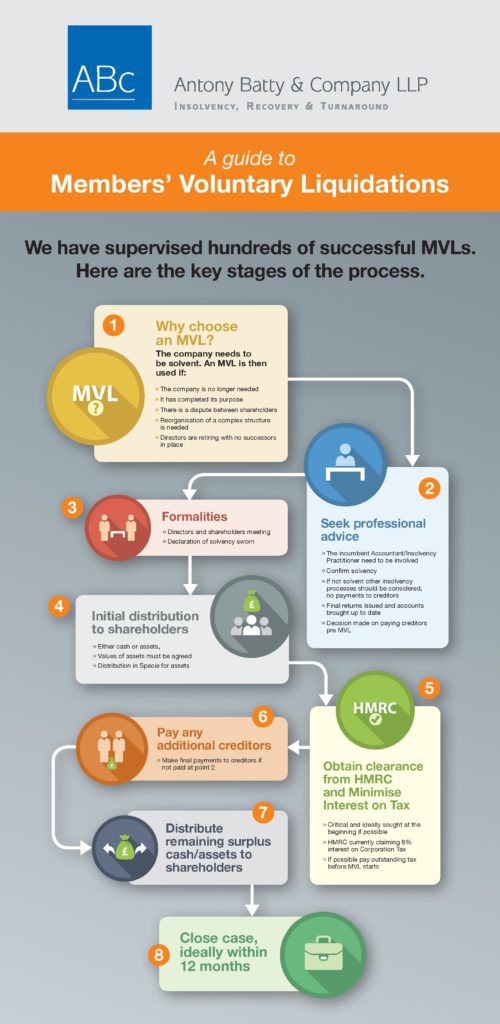

In recent months, we have seen an increase in MVLs as a direct response to the difficulties caused by the Covid-19 pandemic. In these cases, directors who have worked hard to keep their companies solvent have decided that they would prefer to liquidate, get their money out and move on to something new or, perhaps retire.

It is, of course, a big decision to take, and we are here to help in that decision making process. So, talk to us soon, especially before 27th October 2021, where it is possible that BADR will be reduced or scrapped.

Business Asset Disposal Relief might be available if you close your solvent company using a Members Voluntary Liquidation.

When business owners decide to sell or wind-up their solvent company using a Members Voluntary Liquidation (MVL), they might be eligible for Business Asset Disposal Relief (formerly known as Entrepreneurs’ Relief). This has been an attractive and popular method of reducing the amount of Capital Gains Tax that must be paid on the sale of a company and/or its assets, from the standard rate to a 10% rate. It can save business owners many £000s.

In recent budgets there has usually been speculation that BADR will be scrapped – the March 2020 budget saw the relief capped at a lifetime limit of £1 million, for example. Against the background of the huge amount of money the Government has borrowed to fund the costs of Covid-19 come the inevitable concerns of tax rises and cost cuts to pay for it. Once again it is believed that Business Asset Disposal Relief might well be up for abolition – saving the Treasury c.£2.5billion per annum.

Will BADR be scrapped in the October 27th 2021 Budget?

We will not know for sure until the day itself, of course. However, as Hugh Jesseman comments,

“if you are a company owner/director and you are considering selling or winding-up your solvent company using a Members Voluntary Liquidation, now is the time to talk to us. Even if the budget does not scrap Business Asset Disposal Relief, further restrictions/reductions are likely.”

Only a Licensed Insolvency Practitioner can be appointed as Liquidator for an MVL.

Only a licensed insolvency practitioner, such as Antony Batty & Company, can be appointed as a liquidator for an MVL, which means we will know whether a business qualifies for BADR. We have successfully completed hundreds of MVLs since we opened for business in 1997.

If you are thinking about closing down or winding-up your solvent company and want to avoid the likely reductions and restrictions on BADR that we anticipate that the October 27th 2021 budget will impose, then the sooner you talk to us the better.

- Bournemouth 01202 923009